Eligible and Ineligible Contracts

Kansas Corn and NCGA are committed to keeping you informed and passing along best practices as we move through the COVID-19 outbreak in the U.S. Preparations for Spring planting means activity levels are increasing on the farm for things like field preparation and on-farm deliveries. Limiting interactions and exposure is a good idea to limit exposure and risk related to COVID-19 (novel coronavirus). It is critical to practice biosecurity for your family, your employees, the public, and animals.

Kansas Corn compiled this printable document with On-Farm Procedures and Planning tips.

By Josh Roe, Kansas Corn’s VP of Market Development and Public Policy and a Kansas farmer

Haven’t applied for EIDL yet?? WHAT ARE YOU WAITING FOR?!

“It took me less than 10 minutes to apply for the EIDL program on the SBA website and I received my funds the next day.” — Josh Roe

I know that we are all weary from the completely new set of acronyms from the SBA and USDA (There is another one!) and if the applications are open/closed, does agriculture qualify? Do I have to pay it back? Trust me, I’m right there with you!

So, I’m not going to go into a barrage of alphabet soup or send you a bunch of links, I’m simply going to tell you to take 10 minutes and apply for the EIDL program!

Here are step by step instructions:

As of now, ONLY agricultural businesses may apply, so PLEASE take advantage of this golden opportunity. Despite this being a busy time, its well worth it. As a reminder, you are eligible to receive a loan advance of $1,000 per employee, up to $10,000, THIS ADVANCE DOES NOT NEED TO BE REPAID.

New legislation specifically states that agricultural producers are eligible for EIDL emergency advance payments up to $10,000. An additional $484 billion bill mainly aimed at replenishing funds meant to combat the economic downturn related to the Coronavirus has cleared both chambers of congress and is on its way to the President’s desk. Most of the funds ($320 billion) are aimed at replenishing the Paycheck Protection Program (PPP), however agriculture scored a small win with explicit language allowing us to participate in the EIDL program.

A great resource for learning more about EIDL is available from KCOE ISOM here.

Additionally, the SBA page on EIDL is available here, this is the page where the application is made:

EIDL Summary

As with all programs, we strongly encourage you to consult your financial advisor prior to applying.

Still interested in applying for PPP? Don’t wait!

While the infusion of an additional $320 billion in the Paycheck Protection Program is a significant amount of funds. We have heard estimates that this funding is expected to last less than a week. Therefore, time is of the essence to apply for funds.

Kansas Funding in First PPP Round: In the first round of PPP Funding, SBA approved 26,245 loans in Kansas, totaling $4.28 billion in federal relief, most of which will be forgiven as long as the loan recipient keeps their employees, according to Senator Moran’s office.

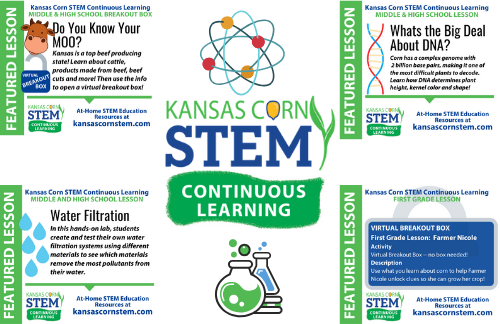

Kansas Corn STEM, the education program of the Kansas Corn Commission is providing at-home lessons for Kansas teachers, parents and students for Continuous Learning. Continuous Learning resources are available for use while students are learning from home or in small groups. Our team of teachers are working hard to create additional Kansas Corn STEM resources tailored to at-home use and available for digital and hard copy distribution. Our goal is to provide “hands on” lessons that can be done using items commonly found around the home. Several lessons are already available and more are being added all the time. Follow the link below for our Continuous Learning lesson listing.

Kansas Corn STEM, the education program of the Kansas Corn Commission is providing at-home lessons for Kansas teachers, parents and students for Continuous Learning. Continuous Learning resources are available for use while students are learning from home or in small groups. Our team of teachers are working hard to create additional Kansas Corn STEM resources tailored to at-home use and available for digital and hard copy distribution. Our goal is to provide “hands on” lessons that can be done using items commonly found around the home. Several lessons are already available and more are being added all the time. Follow the link below for our Continuous Learning lesson listing.

Kansas Corn is working with National Corn Growers Association (NCGA), US Grains Council (USGC) and other partners on resources for COVID-19. Please take advantage of these resources from our state and national partners.

Listen to this April 18 interview with US Grains Council CEO Ryan Legrand, speaking about the pandemic’s impact on export markets–opportunities and challenges.

On March 30, 2020, the State of Kansas began a statewide Stay at Home Order issued by Kansas Governor Laura Kelly. The order was originally effective through April 19, 2020 and was extended through May 3, 2020.

Agriculture Is an Essential Activity: The order directs all individuals to stay in their residence unless performing an essential activity. Agricultural operations still are considered critical infrastructure. This designation ensures that agricultural operations and those that support them can continue operating as normal. Governor Kelly’s order preserves the previously established KS Essential Functions Framework which categorized agriculture and agricultural operations as essential functions. The order specifies that farm owners or workers should not be asked to provide documentation of their work status and allows law enforcement discretion to determine the appropriate course of action in a given situation. Although it should not be necessary, we have included a link below to a sample letter provided by our friends at the Kansas Livestock Association, that you can personalize to indicate that you or your employees are exempt from the stay-at-home order while performing essential functions. Kansas Corn, with our partners in the Kansas Agricultural Alliance, worked with Governor’s office and state government ensure agriculture would be included in the Essential Functions Framework.